- Main Services

- Department

- Kawalan Bangunan

- Kejuruteraan

- Kesihatan Persekitaran

- Perbendaharaan

- Penilaian & Pengurusan Harta

- Perancangan Pembangunan

- Khidmat Pengurusan

- Penguatkuasaan

- Konservasi Warisan

- Perkhidmatan Perbandaran

- Landskap

- Pelesenan

- Pengurusan Korporat Dan Komuniti

- Pesuruhjaya Bangunan

- Unit Undang-Undang

- Unit Audit Dalam

- Unit Penyelarasan Pembangunan

- Unit Pusat Sehenti (OSC)

- Unit Integriti

- Age Friendly City

- Water Level Detection System

- Peta Had Sempadan Penyelenggaraan

Unit Audit Dalam

-

Profile

The Internal Audit Unit was established in the Georgetown City Council under section 52 (1) and (2), Municipal Ordinance since February 1957. The Audit Division was placed under the Council's Treasury Department. In October 1993, the Internal Audit Division was placed under the Municipal Secretary and the name of the Internal Audit Division was changed to the Management Audit Unit. From 1995 the Management Audit Unit was placed under the Chairman of the Council. On February 1, 2005, the Management Audit Unit was changed back to the Internal Audit Unit. From January 1, 2015, the Internal Audit Unit was placed under the Mayor.

-

Objective

-

To help improve financial management to comply with the regulations and laws set and to ensure there is no malpractice or fraud by conducting audits.

-

To submit suggestions for improving good administration by conducting a management audit on the internal control system and the organization's operations.

-

-

Functions

-

Assess the effectiveness of the robustness and adequacy of the organization's internal control structure.

-

Review compliance with policies, plans, procedures, laws and regulations.

-

Verify the existence of assets and determine that they have been properly accounted for and protected against any type of loss.

-

Check the reliability of the validity of financial information and operational data by evaluating overall computer security controls and procedures in data processing.

-

Conducting special inspections and reviews requested by management including investigating reports of fraud, breach of trust, theft and waste and recommending controls to prevent and detect any such incidents.

-

Evaluate the economy and efficiency of the use of resources used and suggest improvements in operations.

-

Determining the extent to which the objectives and targets set for the operation or program are achieved in an effective manner and in line with the laws and regulations that have been set.

-

-

Our Services

- Compliance Audit Section

a. Review compliance with policies, plans, procedures, laws and regulations

Ensure whether the department/ unit complies with the rules, instructions, policies, financial procedures, Treasury/ Services and Council Circulars. Audit recommendations usually encourage improvements in processes and controls aimed at ensuring compliance with regulations.- Financial Audit Section

Controlling/preventing to avoid any defects and deviations from happening for the following matters:-

-

Vouchers for payment

-

Multiple refunds

-

Council Savings Fund 1898, 1935 and 1969.

-

- Management Audit Section

Make a physical inspection of the stock of spare parts, furniture and appliances belonging to the Council. In addition, carry out the verification process of the documents for the implementation of the contracts as follows:-

-

Taking stock of spare parts

-

asset purchase

-

Review of Council contracts

-

Assessment tax

i. City Area

ii. Rural

-

- Special Duties Audit Section

Conducted if there is a request from a department officer or administrative management. This audit is focused on rules and malpractice behavior to ensure whether there is a violation of civil or criminal law and violations of policies and rules including internal theft, misuse of Council assets and abuse of power.

Conducting audit appearances against:-

-

Council payment counters

-

Stationery stock

-

Pick up grocery money

-

Majlis vehicle log book

-

Management of receipt and distribution of official letters

-

Majlis Store

-

Leave and time off records

-

- Complaint Investigation Audit Section

Conducting investigations with the direction of the Mayor as well as investigating complaints and so on to prevent irregularities and irregularities. - Performance Audit Section

An audit conducted to determine whether a department is using resources economically, efficiently and effectively in carrying out its responsibilities, audit objectives:-

-

Improve the management of public sector resources

-

Improving the quality of delivering information about the Council's financial management to stakeholders and

-

Encourage public sector management to introduce a process of reporting performance levels for activities/programs implemented.

-

- Follow-up Audit Section (Dashboard)

a. Manage the Internal Audit Unit dashboard to monitor the actions taken by the department on auditing issues.

b. Ensuring that projects and activities are carried out according to schedule and that the agency gets the best benefit value.

c. Assessing whether projects and activities have weaknesses and subsequently taking corrective and improvement actions.

d. Displays the latest issues and status of the Chief Internal Auditor's and Chief Auditor's Reports.

-

Clients Charter

1

Hold Internal Audit Unit Management meetings every month.

2

Management/ Finance/ Activity auditing tasks are carried out within six (6) weeks and prepare and issue Management/ Finance/ Activity audit reports within three (3) weeks.

3 a. The audit appearance task is carried out within one (1) day

b. Prepare and issue an audit appearance report within one (1) day

c. Audit appearance at least one (1) case per month.

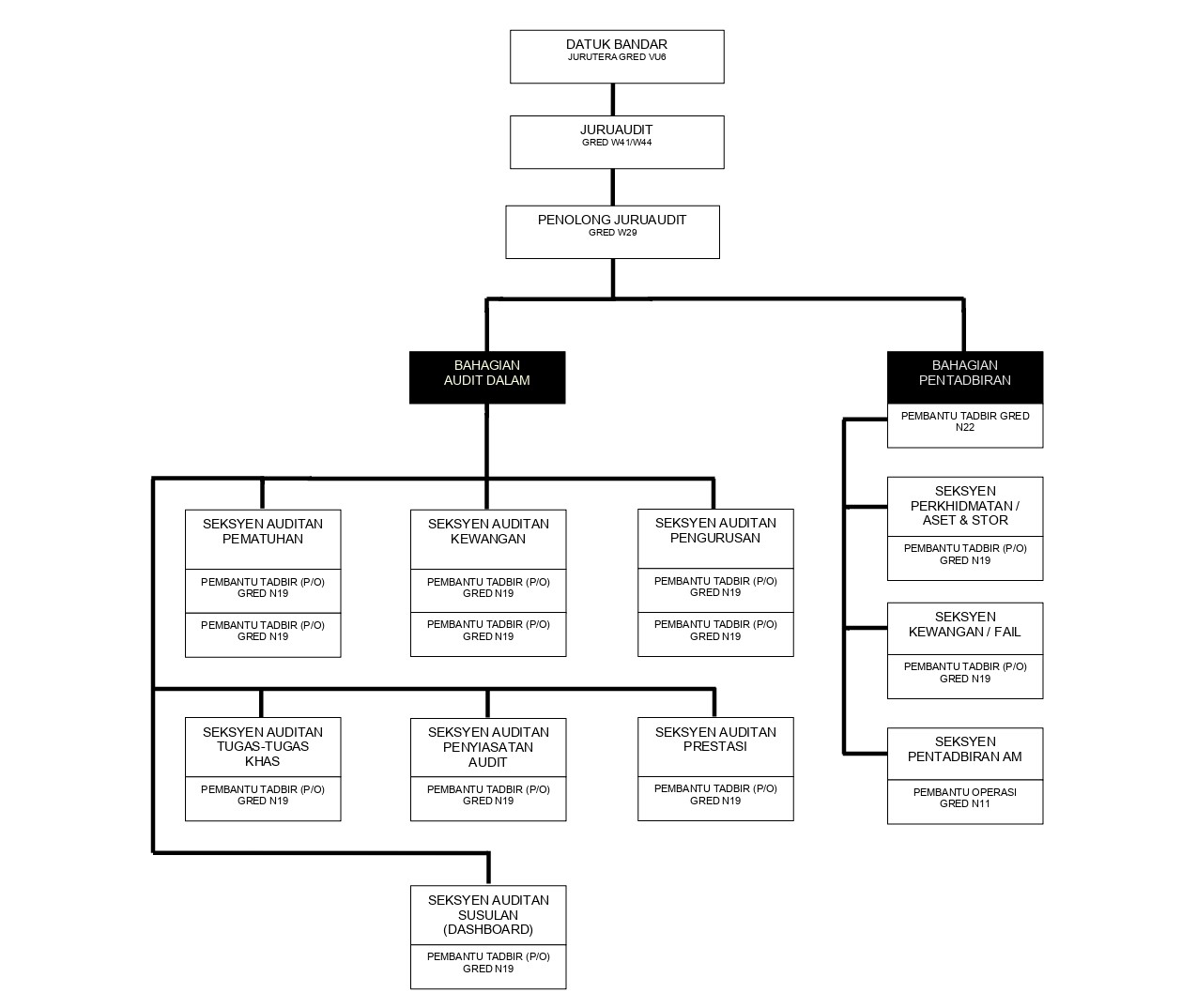

4 Take follow-up and monitoring actions against Departments/Divisions to be able to submit any audit questions within seven (7) working days. 5 The auditing task for the complaint audit will be carried out within six (6) weeks and prepare and issue the complaint audit report within three (3) weeks after the audit. 6 Prepare a payment voucher and deliver it to the Treasury Department within seven (7) days from the date of receipt of the invoice. 7 Complaints received will be acted upon within two (2) working days and an answer will be given within three (3) working days from the date of receipt of the complaint. - Organisation Chart

-

Directory

Name

Position

Telephone (Office)

Email[at]mbpp[dot]gov[dot]my

Janita Thomas Felix

Ketua Audit Dalam

259 2148

janita

-

Penolong Juruaudit

259 2184

-

Siti Nur’ain bt Ruslan Penolong JuruauditSamb 2514 sitinurainMuhammad Zainuddin bin Baharudin Penolong JuruauditSamb 2515 mzainuddinIsliza Hanim bt Ismail Pembantu Tadbir Kanan259 2042 islizahanim -

Contact Us

Phone -

Email -

Address Unit Audit Dalam, Majlis Bandaraya Pulau Pinang, Tingkat 11, Komtar, Jalan Penang, 10675, Pulau Pinang.

-

Main Policy and Guidelines

Click on the link https://www.mbpp.gov.my/en/corporate/sumber/dasar-garis-panduan

-

Downloads

Click on the link https://www.mbpp.gov.my/en/muat-turun-borang

-

Legislations

Click on the link https://www.mbpp.gov.my/en/corporate/legislation

-

Publications

Click on the link https://www.mbpp.gov.my/en/corporate/sumber/penerbitan-2

MS

MS  EN

EN